Amazing Info About How To Avoid Pmi When Refinancing

Four ways to get rid of pmi wait for pmi to automatically fall off.

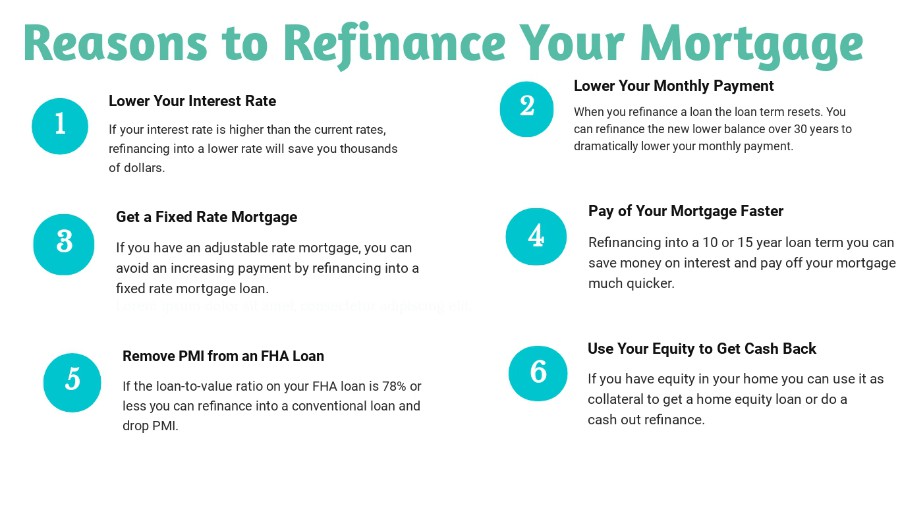

How to avoid pmi when refinancing. Take advantage of the government gse's mortgage relief product before it's too late. For conventional loans, pmi automatically drops off once the loan balance is at. You can avoid pmi by simultaneously taking out a first and second mortgage on the home so that no one loan constitutes more than 80% of its cost.

This is easier said than done, especially if you’re buying your first home. Refinancing your home is one way to avoid pmi payments (and it's a particularly smart time to refinance given today's mortgage rates). Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

Another way to get rid of pmi is to refinance your mortgage. Can i remove pmi with a new appraisal? Ad discover the best no closing cost refinance options.

Trusted by 45 million+ users Private mortgage insurance (pmi) can be avoided by with a down payment of 20% or more or ended early by building up a 20% equity stake in a home. Put 20% or more down.

If you have an fha loan, insured by the federal housing administration, you may have to pay the mortgage insurance premium (mip). Refinance to get rid of pmi. If you already have a mortgage with pmi, the pmi can generally be canceled.

If your lender won’t drop the monthly pmi requirement but your ltv is less than 80%, you can likely refinance the loan without pmi. Is paying pmi or mip worth it? View today's rates for free.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)