Outstanding Info About How To Avoid Withholding Tax

Too much can mean you won’t have use of.

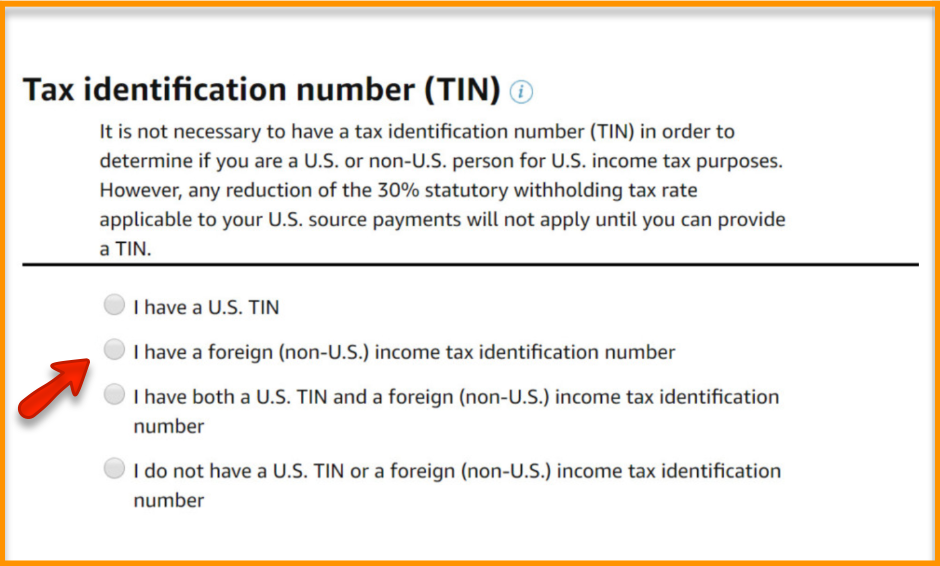

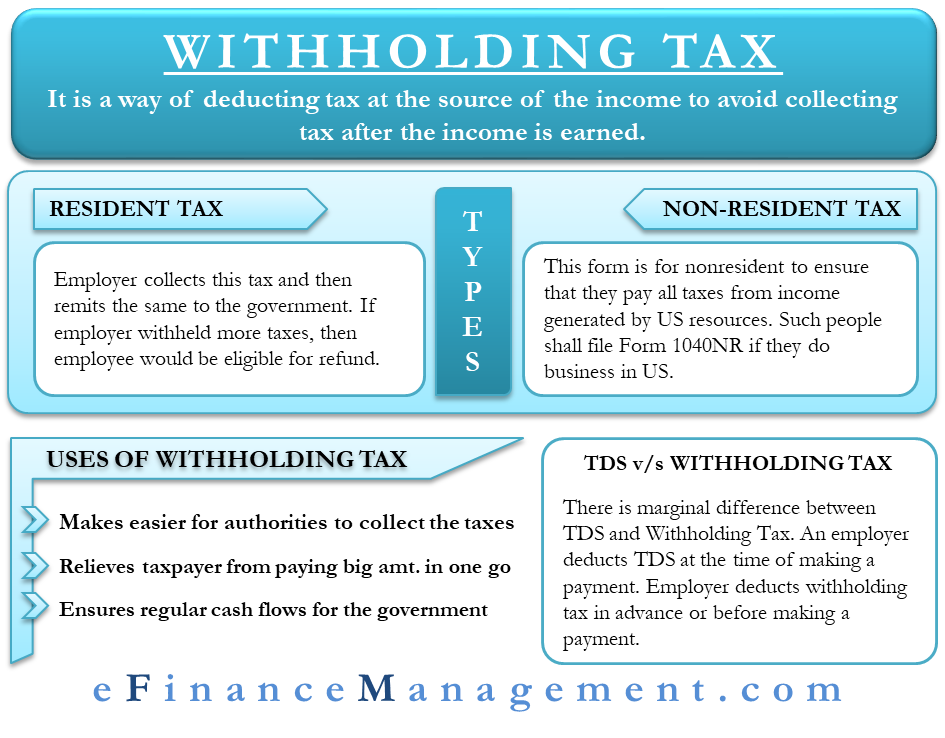

How to avoid withholding tax. Among the countries that don't withhold foreign investors' dividends are. Ask your employer if they use an automated. One of the best ways to avoid dividend withholding tax is to invest in countries without such a tax.

To change your tax withholding amount: The irs urges everyone to do a paycheck checkup in 2019, even if they did one in 2018. How to avoid withholding tax on dividends.

In case a tax treaty exists between the two countries, the rights seller has to provide a certificate of tax residency, or tax exemption form, to reduce or avoid such withholding taxes. As a result, any amounts distributed from a 401(k) to its owner will be reduced by 20% and that 20% will be sent to the irs in expectation of the taxes that will be due from the. The second way to avoid paying rrsp withholding tax is if the money is to be used to finance your education, as part of the government’s lifelong learning plan (llp).

In general, the more dependents you claim, the less federal income tax you pay. Taxpayers can avoid a surprise at tax time by checking their withholding amount. Here is a little know fact, or at least it seems that way.

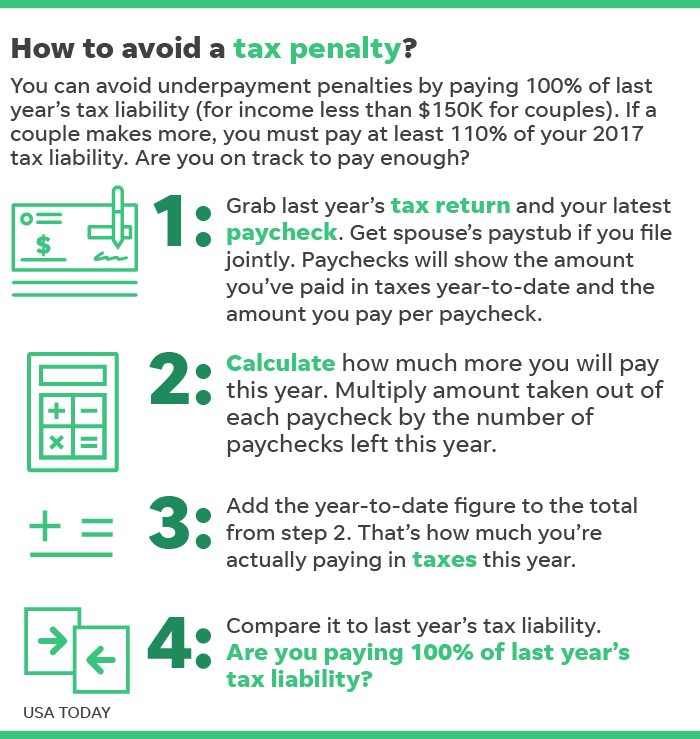

How to reduce withholding tax on rrsp withdrawals. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated. As discussed above, depending on the amount withdrawn, financial institutions are required to withhold a minimum amount of tax.

Why you should change your withholding or make estimated tax payments. Too little can lead to a tax bill or penalty. To reduce the withholding tax, a global investor must choose an etf domicile that has an advantageous tax treaty with the us, since us.