Fine Beautiful Tips About How To Become A Bankruptcy Trustee Canada

Bankruptcy trustees are known officially as licensed insolvency trustees (lits) and are qualified to assist you with your debt after years of experience, passing a series of exams, and being.

How to become a bankruptcy trustee canada. Bankruptcy and insolvency records search a database of all bankruptcies and. Whether the reasons for your considering bankruptcy in new brunswick are due to job loss, wage garnishment, or because of unpaid credit card or other bills, our local new brunswick licensed. To file for bankruptcy, you need to work with a trustee, who will administer your bankruptcy.

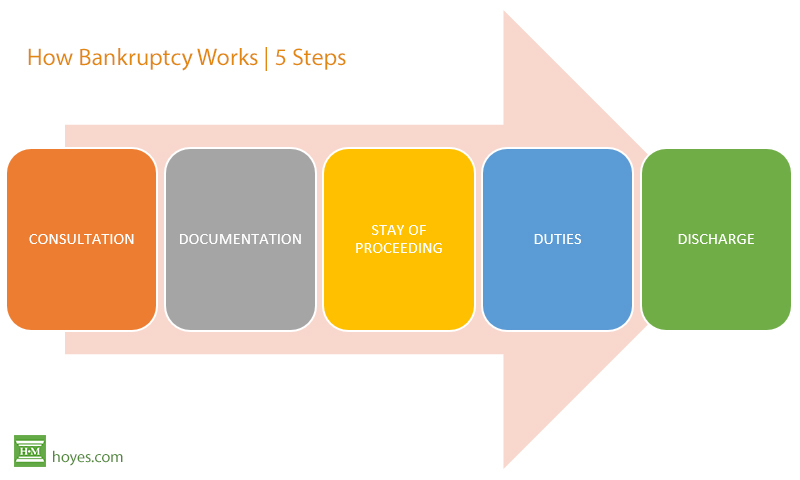

Bankruptcy is a legal process by which you may be discharged from most of your debts. You can find a trustee in your area here. By law you must work with a licensed insolvency trustee when filing bankruptcy or a consumer proposal in canada.

Must pass a rigorous three year bankruptcy law course; Be of good character and reputation. Submit your resume to the appropriate district office of the u.s.

Successfully complete the chartered insolvency and restructuring. How to become a licensed insolvency trustee. Trustees are also the most highly trained and educated debt experts in.

Be of good character and reputation. The trustee will provide you with. They will carry out a debt assessment, and help.

Vacancies are filled on a periodic basis, so check back if. Uncover a few essential specifics in choosing an individual bankruptcy law firm. A bankruptcy trustee will discuss your financial circumstances in detail, and determine your debt and debt relief options.