First Class Info About How To Lower Credit Apr

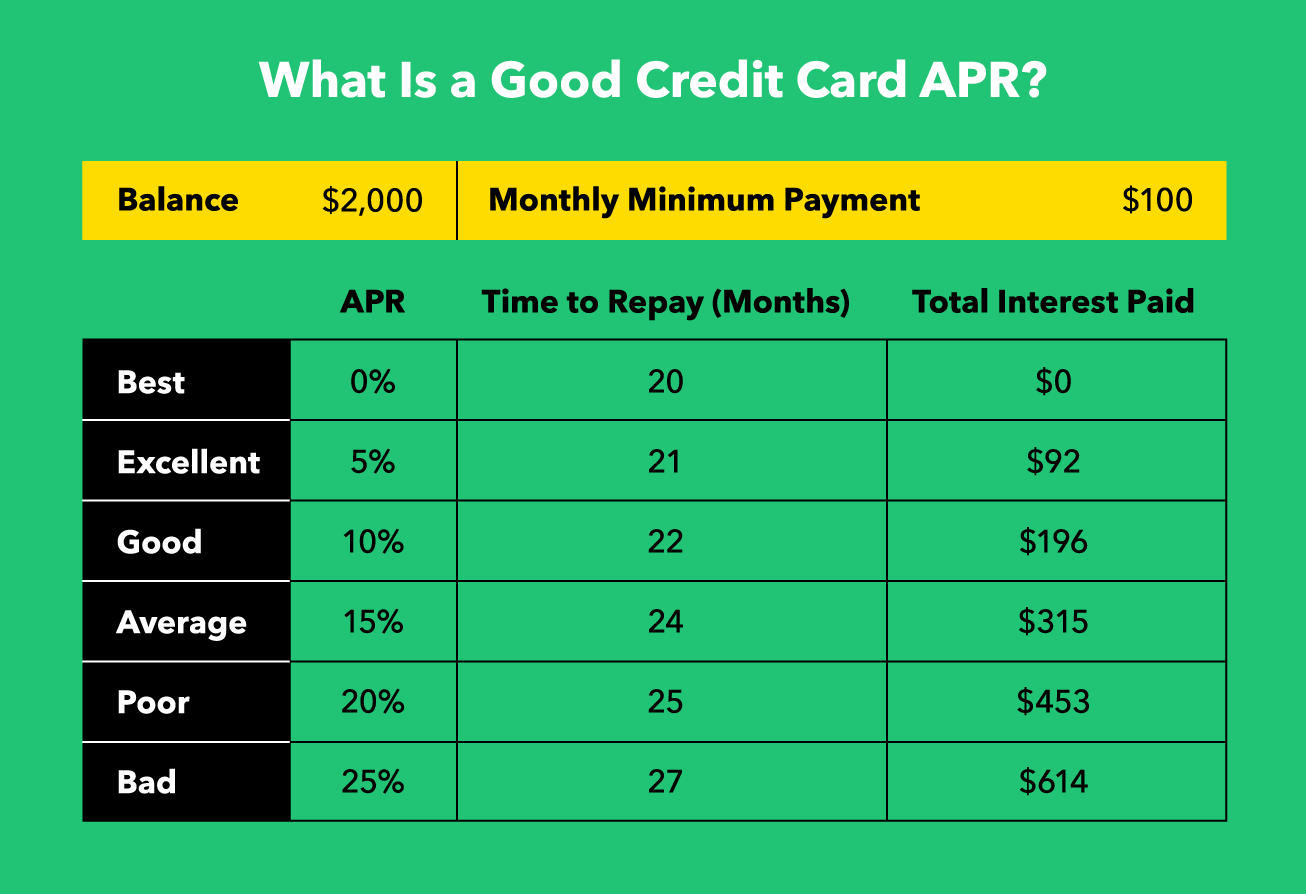

In turn, this can make it easier and faster to pay off.

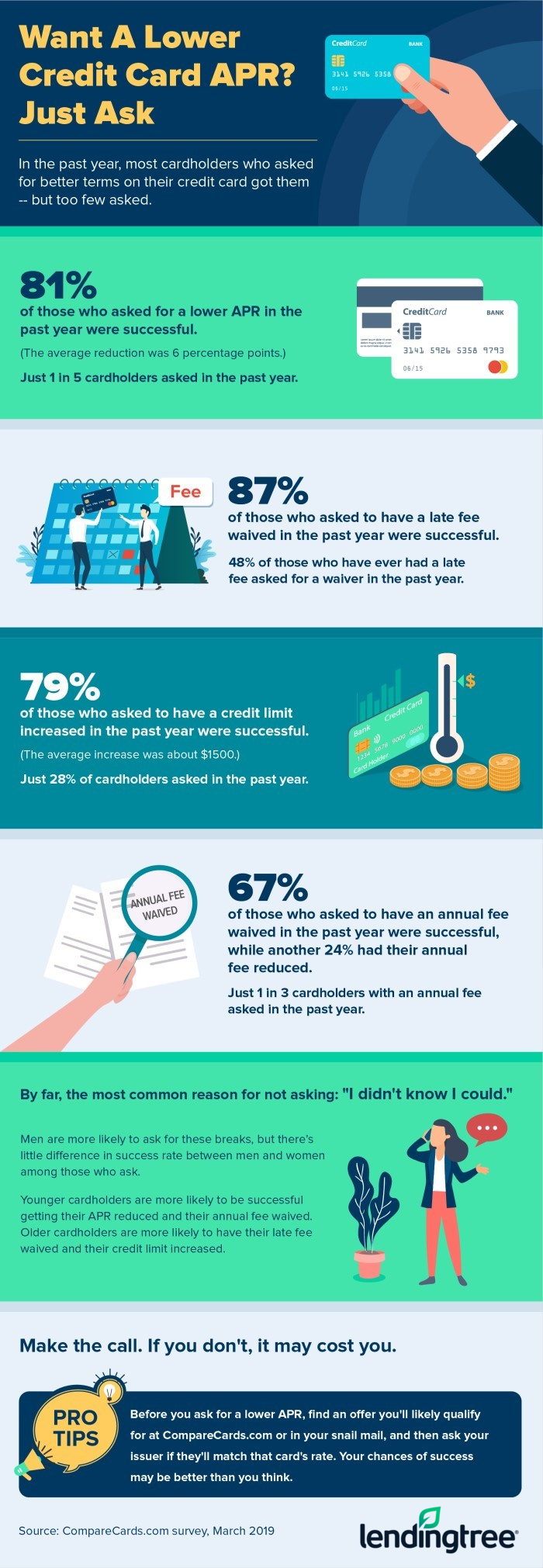

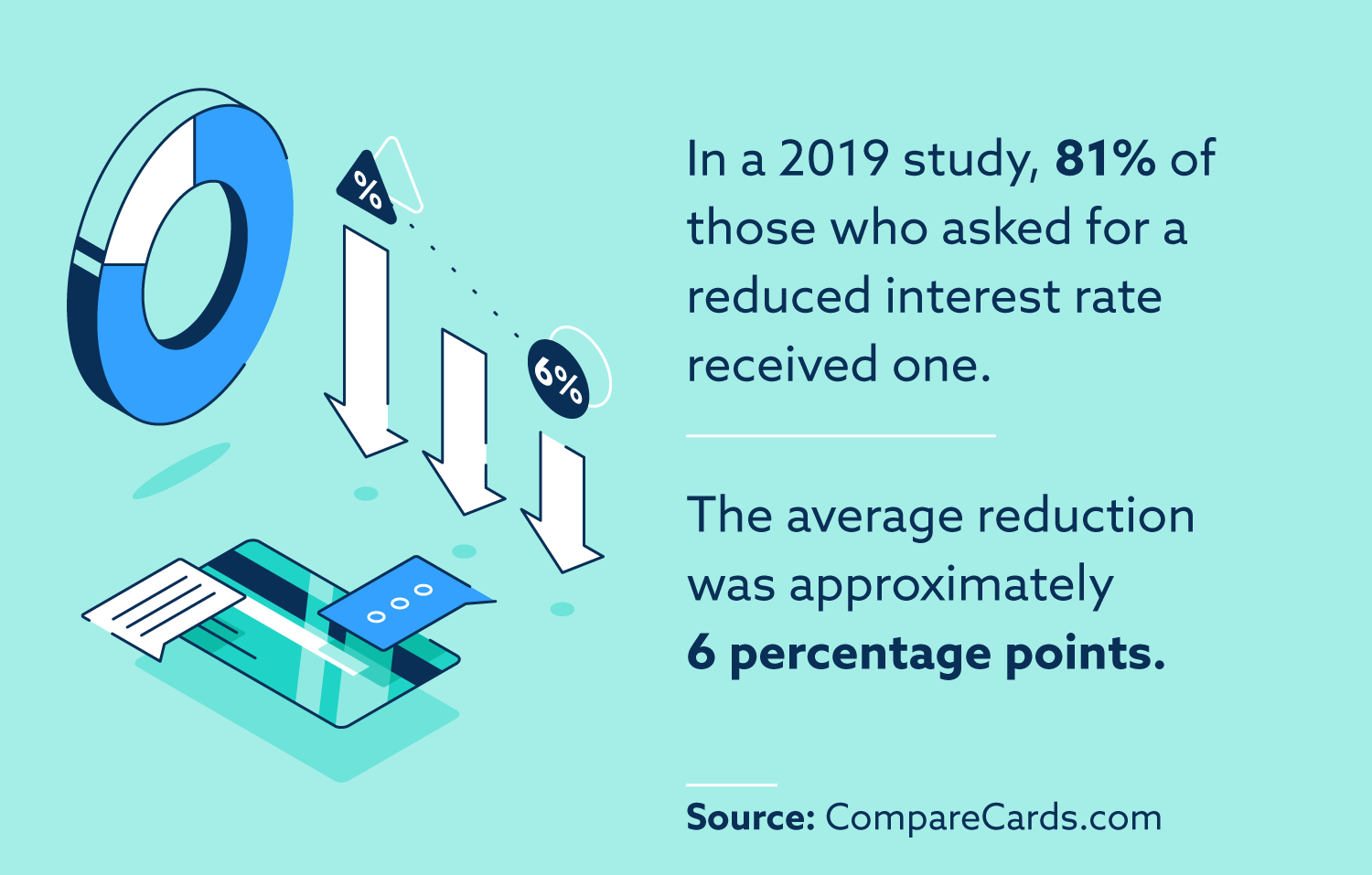

How to lower credit apr. A lower interest rate can save consumers money. Contact your credit card issuer and explain why you would like an interest rate reduction. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a.

Your credit card company won't lower your apr just because you've been taking care of your credit; How to lower your credit card interest rate 1. Here's how to negotiate with credit card companies.

You need to call them and ask them to lower your apr! Cut debt by 50% or more. How to lower your credit card interest rate 1.

You need to talk with someone who can lower your apr and waive the annual fee. Assess your situation every customer’s circumstances are different. Persistence is key when negotiating a lower credit card apr.

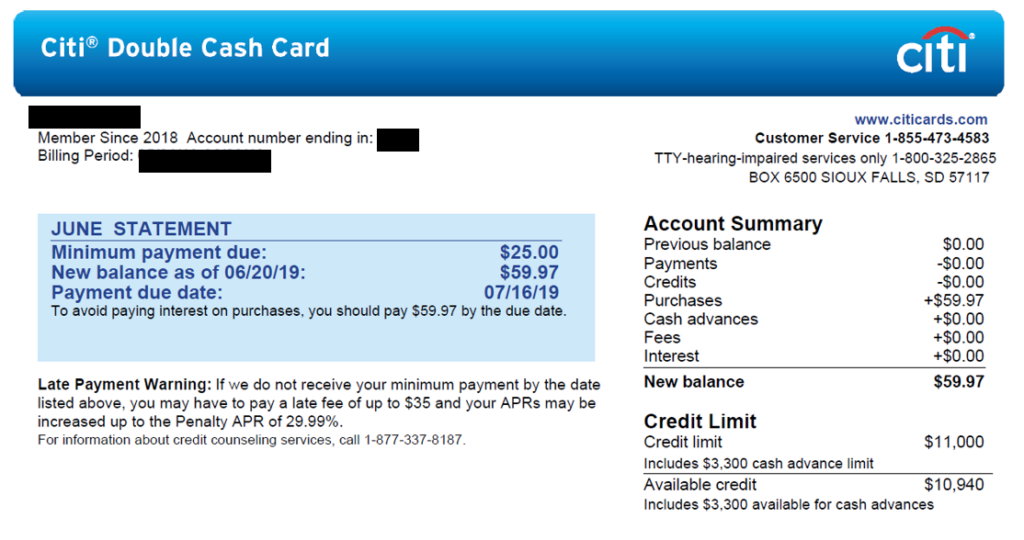

How can i lower my credit card apr? Ad consolidate $20,000 or more. If the representative says they.

Banks make this decision based on their product lineup: However, be prepared for the representative’s. Here’s a quick look at the different credit card aprs you can expect to find on your account and what they mean.